“Below-average price performance expected for US equities”

Equities

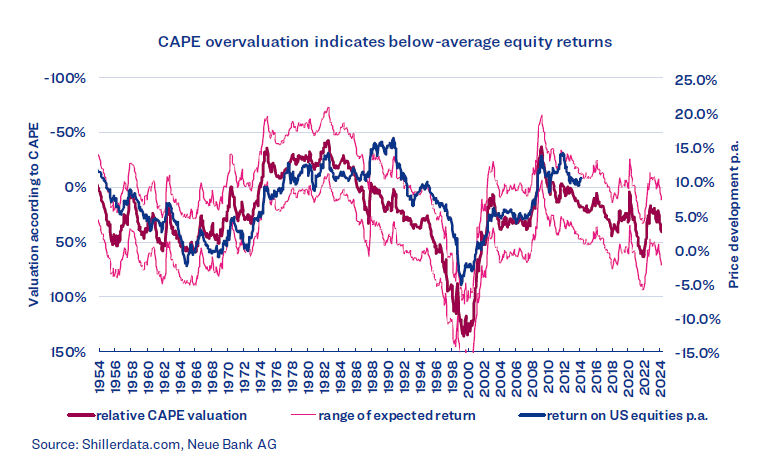

We do not explicitly expect below-average price gains in the current year, but on average over the next 10 years. We derive this expectation from the cyclically adjusted price-to-earnings ratio (CAPE). CAPE is a valuation ratio for assessments over an entire economic cycle – consisting of upswing, boom, and recession. CAPE sets the earnings of the last 10 years in relation to the current share price. If this ratio is above the 40-year average, it can be assumed that shares are overvalued and vice versa. Overvaluations and undervaluations are not immediately balanced out, however; it takes a certain amount of time for them to move back towards fair value. For that reason, valuation indicators are not suitable for “timing” the equity market, i.e. as a basis for shortterm transactions. But CAPE does give an indication of how equities will perform over a period of 10 years, which the inventor of the indicator probably assumed to be the approximate duration of a cycle:

The left scale (inverted) shows the deviation of the valuation from the 40-year average. At fair valuation (0%), the performance over the following 10 years should be slightly below 10% per year (right scale). The blue line is used to check whether the expectations based on the respective valuation (dark red line) have materialised. As the chart shows, the return achieved is usually within the estimates (range). However, there are also phases with larger deviations. In the 1990s, changes in accounting rules and other factors led to lower reporting of earnings for reasons of tax optimisation. Based on the current valuation (dark red line), it can be assumed that equity returns in the United States will be below average in future. In contrast, Barclays data indicates that the current CAPE valuations for European and Swiss equities are slightly below the 40-year average. This means above-average performance is possible in these two regions.

“Our traffic light is still light green, so we remain overweight in equity investments.”

Bonds

To estimate future income from bonds, the yield level is more meaningful than valuation metrics. In the case of an individual bond, you already know at the start of the investment how much you will receive (interest + repayment), provided no default occurs. The 10-year yields on government bonds are highest in the US (4.26% p.a.); in Germany, bond investors still earn 2.36% p.a., while investors in Switzerland earn only 0.61% p.a. These yields can be improved by adding corporate bonds or even high-yield and convertible bonds, but doing so also increases the risk.

Currencies

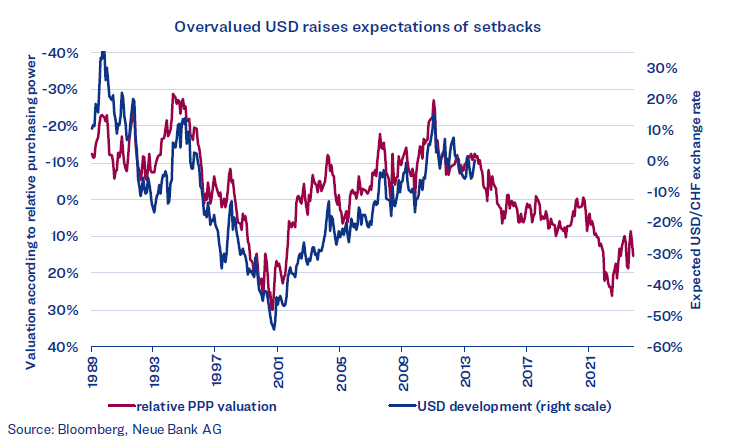

It is less commonly known that currencies can be valued as well. Relative purchasing power parity can be used to measure how much a currency would have to depreciate or appreciate in order to return to fair value. Purchasing power adjustments are often based on changes in producer prices. We show this below using the example of the USD/CHF exchange rate:

Here again, over- or undervaluations frequently occur, which balance each other out over time. While inflation – as measured by the producer price index (PPI) – has been nearly zero in Switzerland over the last 34 years, it has been about 2.5% p.a. in the US. This has led to a significant weakening of the USD against the CHF. At fair valuation, the expected currency change is accordingly not 0%, but rather slightly over -10%. This also means that the estimate only works if the PPI regime that has become established over the course of decades does not change. Otherwise, the overvalued USD is expected to depreciate by about 30% over the next 10 years. The situation is practically the same for the EUR against the CHF, which is threatened by a similar decline. The EUR/USD exchange rate is currently fairly valued. There will always be temporary movements that run counter to the long-term trend or fair value. Last month, for instance, we removed the EUR hedge in our CHF mandates on the basis of a signal from our currency indicator, leading us to expect the EUR to strengthen temporarily.

Alternative investments

Last month, gold reached a price of more than USD 2,200 per ounce – a new all-time high. Since the abolition of the gold standard in 1971, gold has gained nearly 8% per year. This price increase was very unevenly distributed, however. In the first approximately 10 years, the price of gold rose from USD 42.00 to more than USD 650.00. After a fall of more than 60%, it then took over a quarter of a century to reach the USD 650.00 mark again. A new bull market phase began at the start of the new century, driving the price to over USD 1,900.00 by 2011. This was again followed by a slump of more than 40%. The trend has been positive again since the beginning of 2016. In contrast to other asset classes, we do not believe it is possible to value the price of gold. In the words of former Fed Chairman Alan Greenspan:

“The price of gold? That’s substance plus faith and fear minus interest.”

Because we do not believe this formula is resolvable, we refrain from articulating a concrete price expectation.

Economy

The purchasing managers’ indices for manufacturing are below the threshold of 50 in the US, the Eurozone, and Switzerland, which means they are predicting a decline of the economy. The lowest levels have already been overcome, however. The Swiss National Bank made its first interest rate cut in March. The market is also expecting cuts in the US and Europe in June or July, which should have a positive impact on the economy.

Downloads